Rare Earth Elements: Where in the World Are They?

Category: News & Politics

Via: tig • 2 years ago • 41 commentsBy: Nicholas LePan (Visual Capitalist)

China's rare earth dominance gives it a major upper hand given the future of the planet depends upon rare earth elements.

[ An older article but still highly relevant. ]

Rare Earths Elements: Where in the World Are They?

Rare earth elements are a group of metals that are critical ingredients for a greener economy, and the location of the reserves for mining are increasingly important and valuable.

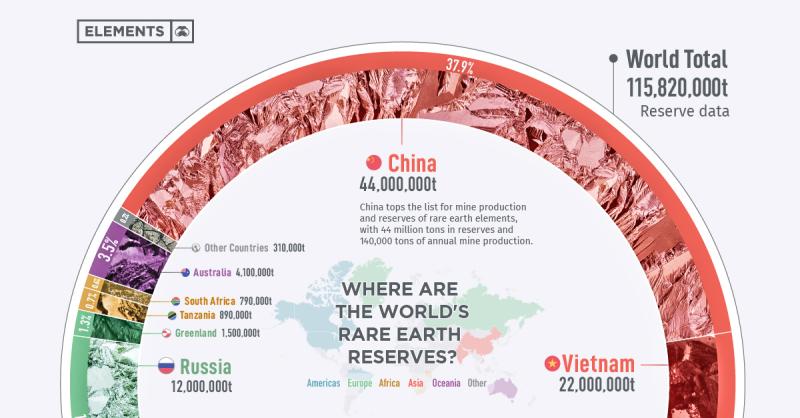

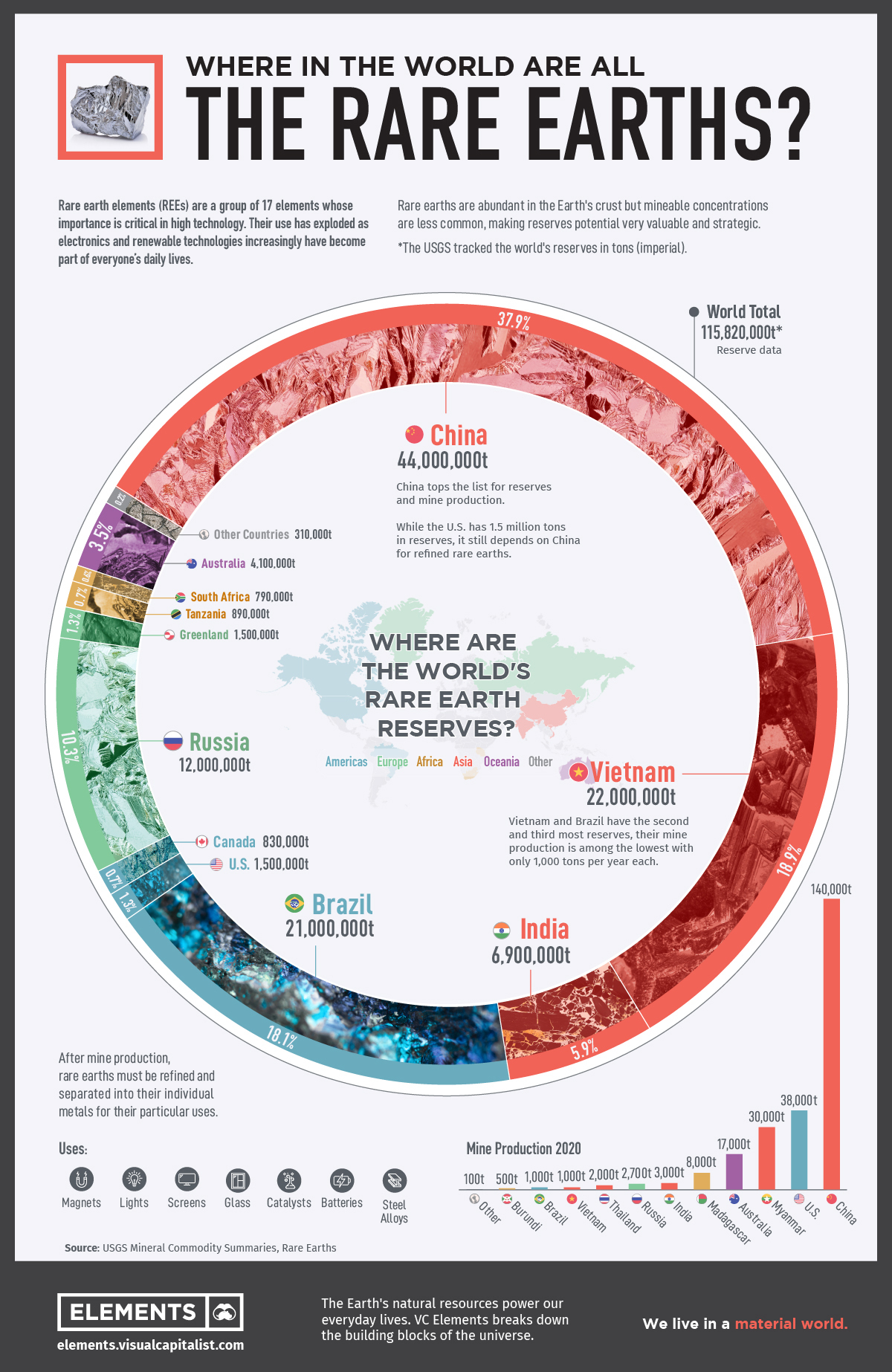

This infographic features data from the United States Geological Society (USGS) which reveals the countries with the largest known reserves of rare earth elements (REEs).

What are Rare Earth Metals?

REEs, also called rare earth metals or rare earth oxides, or lanthanides, are a set of 17 silvery-white soft heavy metals.

The 17 rare earth elements are: lanthanum (La), cerium (Ce), praseodymium (Pr), neodymium (Nd), promethium (Pm), samarium (Sm), europium (Eu), gadolinium (Gd), terbium (Tb), dysprosium (Dy), holmium (Ho), erbium (Er), thulium (Tm), ytterbium (Yb), lutetium (Lu), scandium (Sc), and yttrium (Y).

Scandium and yttrium are not part of the lanthanide family, but end users include them because they occur in the same mineral deposits as the lanthanides and have similar chemical properties.

The term "rare earth" is a misnomer as rare earth metals are actually abundant in the Earth's crust. However, they are rarely found in large, concentrated deposits on their own, but rather among other elements instead.

Rare Earth Elements, How Do They Work?

Most rare earth elements find their uses as catalysts and magnets in traditional and low-carbon technologies. Other important uses of rare earth elements are in the production of special metal alloys, glass, and high-performance electronics.

Alloys of neodymium (Nd) and samarium (Sm) can be used to create strong magnets that withstand high temperatures, making them ideal for a wide variety of mission critical electronics and defense applications.

| End-use | % of 2019 Rare Earth Demand |

|---|---|

| Permanent Magnets | 38% |

| Catalysts | 23% |

| Glass Polishing Powder and Additives | 13% |

| Metallurgy and Alloys | 8% |

| Battery Alloys | 9% |

| Ceramics, Pigments and Glazes | 5% |

| Phosphors | 3% |

| Other | 4% |

Source

The strongest known magnet is an alloy of neodymium with iron and boron. Adding other REEs such as dysprosium and praseodymium can change the performance and properties of magnets.

Hybrid and electric vehicle engines, generators in wind turbines, hard disks, portable electronics and cell phones require these magnets and elements. This role in technology makes their mining and refinement a point of concern for many nations.

For example, one megawatt of wind energy capacity requires 171 kg of rare earths, a single U.S. F-35 fighter jet requires about 427 kg of rare earths, and a Virginia-class nuclear submarine uses nearly 4.2 tonnes.

Global Reserves of Rare Earth Minerals

China tops the list for mine production and reserves of rare earth elements, with 44 million tons in reserves and 140,000 tons of annual mine production.

While Vietnam and Brazil have the second and third most reserves of rare earth metals with 22 million tons in reserves and 21 million tons, respectively, their mine production is among the lowest of all the countries at only 1,000 tons per year each.

| Country | Mine Production 2020 | Reserves | % of Total Reserves |

|---|---|---|---|

| China | 140,000 | 44,000,000 | 38.0% |

| Vietnam | 1,000 | 22,000,000 | 19.0% |

| Brazil | 1,000 | 21,000,000 | 18.1% |

| Russia | 2,700 | 12,000,000 | 10.4% |

| India | 3,000 | 6,900,000 | 6.0% |

| Australia | 17,000 | 4,100,000 | 3.5% |

| United States | 38,000 | 1,500,000 | 1.3% |

| Greenland | - | 1,500,000 | 1.3% |

| Tanzania | - | 890,000 | 0.8% |

| Canada | - | 830,000 | 0.7% |

| South Africa | - | 790,000 | 0.7% |

| Other Countries | 100 | 310,000 | 0.3% |

| Burma | 30,000 | N/A | N/A |

| Madagascar | 8,000 | N/A | N/A |

| Thailand | 2,000 | N/A | N/A |

| Burundi | 500 | N/A | N/A |

| World Total | 243,300 | 115,820,000 | 100% |

While the United States has 1.5 million tons in reserves, it is largely dependent on imports from China for refined rare earths.

Ensuring a Global Supply

In the rare earth industry, China's dominance has been no accident. Years of research and industrial policy helped the nation develop a superior position in the market, and now the country has the ability to control production and the global availability of these valuable metals.

This tight control of the supply of these important metals has the world searching for their own supplies. With the start of mining operations in other countries, China's share of global production has fallen from 92% in 2010 to 58%85% of the world's refined rare earths in 2020.

China awards production quotas to only six state-run companies:

- China Minmetals Rare Earth Co

- Chinalco Rare Earth & Metals Co

- Guangdong Rising Nonferrous

- China Northern Rare Earth Group

- China Southern Rare Earth Group

- Xiamen Tungsten

As the demand for REEs increases, the world will need tap these reserves. This graphic could provide clues as to the next source of rare earth elements.

The nations which provide the most rare earth elements are not the ones on which we would want to be dependent.

Very slim pickings when dealing with friendly governments. I would say that Brazil is our best choice, but they are underproducing at the moment.

I would take Vietnam over Brazil. If Bolosorano loses in the next election then perhaps Brazil might be next on the list.

I know I know, I am an earthly rare element. No need to write about it...s/

The only problem I see is if war broke out. Otherwise I say let them dig up and destroy their own countries. All we have to do is buy.

Monopolies are a bad thing. What happens if China/Russia decides to up the price or hold rare earth elements as a bargaining chip?

Can be a double edge sword Imo. If no one buys their minerals they would make concessions I would think.

Look how much it impacts a country when their oil is not purchased.

Key is that we do not have the option to not buy. These elements are essential to the present and future. We must buy from somewhere and the uber-suppliers are not nations on whom we want to depend.

Seems going green is not very green.

There is a good argument to be made in support of that (at least in the early stages).

Very slim pickings but I wonder how much material is every American garage or home office?

I have two towers & 3 laptops, at least one very fancy monitor that needs a capacitor, VCRs, chargers

in a box in the garage waiting for months, maybe more, for me to call the recycler to pick up.

In the office a we have a pile of old Apple phones that can (should) be donated or recycled.

Remember that WWII was won with scrap drives. 5 million tons of metal in the first month?

Can you imagine what's in some of our landfills? 69 million pounds?

National Overview: Facts and Figures on Materials, Wastes and Recycling | US EPA

Currently between one and five % of REE are being recycled. There are some difficulties in doing it and there are a number of companies that are working on making it easier and quicker.

One day we will dig up landfills to get what was dumped there

Thought this might be a worthwhile item to add to your seed.

Weren't we told that China would build the Belt & Road through the Whakjhir Pass to get to

the mountains of rare earth minerals and other raw ores and expand their toehold there?

Hasn't happened, nor has anyone in Afghanistan sought to cash in yet.

No capitalism, no progress?

I have much difficulty understanding the government and capitalists in the US. I rarely try to second guess the owners of China.

Afghanistan is rated 6th in the world for rare earth metals, plus billions of dollars or iron ore and other minerals. This is an article from 2011 on it and there have been more recent articles confirming that massive deposits of rare earth metals and other minerals.

Maybe why China was in such a hurry to establish diplomatic relations with the Taliban after our withdrawal.

in 2007 China signed a $2 plus billion dollar deal to mine in Afghanistan, they have not mined anything after the signing of the deal. Here is a good article on China/Afghanistan rare earth metals. The section about the ''lithium triangle'' in South America is really interesting.

And one of three places in the world where you find Lapis Lazuli.

I've wondered what China's eventual reaction might be when America banned Huawei, imposed significant tariffs on Chinese products, blacklisted a number of Chinese corporations, banned the sale of certain kinds of microchips to China, demonized and bashed China, formed organizations of other nations to pressure China, provoked China by disregarding the One China Policy that the USA says it still honours (like hell it does), passing resolutions interfering in China's domestic affairs, etc etc etc. Obviously the trade benefits with the USA are more important to China than blocking the sale of REE to America, but they could decide to impose some hefty tariffs, couldn't they?

China could do a lot of things, but I suspect their leadership will play the long game to benefit their society instead of seeking short term gratification that might benefit the few. This is something that US leadership seems to be incapable of.

I googled for an overview of the China business model vs the United States business model. The article below is short but gives some insight on cultural differences. The comments are informative, also.

Thanks, interesting. What did you learn about China’s business practice of theft of intellectual capital, Estimates at the cost of this stealing range from $400-$600 billion a year or $4-12 trillion over the last 20 years from the US along.

People in glass houses......etc.

.

Washington behind shameless cyber-attacks

LINK ->

My comment was about the common Chinese business practice of stealing intellectual property and copy right infringement. If you want to discuss cyber attack OK. I hope the link you sent you s true, retaliatory hacks are long overdue.

Seven years ago, the US Office of Personnel Management (OPM), the agency that manages the government's civilian workforce, discovered that it’s personnel files had been hacked. Among the sensitive data was mine and millions of others SF-86 forms, These forms have info from background checks for people seeking government security clearances.

Cyber forensics trace back to Chinese state-sponsored hackers.

You're right, I misinterpreted. As for business practices, it was my understanding that in China those who wanted to do business in China were required to provide the information you're describing. It was NOT stolen and they were NOT forced to do it, because if they didn't all that would happen is that they were not permitted to do business in China. So it wasn't theft, the choice was up to the foreign corporations. Greed is more important to those who are looking for more than a billion new consumers.

How do you think China's economy would have developed it the West had stayed away?

You still are. Some hacking is ,like traditional government espionage, and some is criminalby the state:

A new report by Boston-based cybersecurity firm, Cybereason, has unearthed a malicious campaign — dubbed Operation CuckooBees — exfiltrating hundreds of gigabytes of intellectual property and sensitive data, including blueprints, diagrams, formulas, and manufacturing-related proprietary data from multiple intrusions, spanning technology and manufacturing companies in North America, Europe, and Asia.

Birds do it. Bees do it. Even educated fleas do it. Let's spy on each other.

Somehow I don't think that China is the only technologically advanced nation in the world that spies on other countries.

How much intellectual property do you think Germany steals, France, Japan?

Or were you thinking of Russia and North Korea?

America doesn't spy on other nations?

Do you believe that the US has stolen trillions of dollars of IP from China?

When you answer my question I'll answer yours, but now it's 10 pm and I'm turning off my computer, but will be back here in the morning.

When you return, please answer my question in 7.1.5. and 7.1.7.

That not the topic unless you're changing it. My original comment was theft of IP as a business practice in China.

This is an article in Forbes from 3 years ago the gives some insight on your question to me.

and more info why American companies are loathe to leave China. Also, an older article so I don't know how much has actually changed.

more...

It may have taken a longer time.

How can I possibly have an answer to that?

No.

Now you can answer MY question, and I would appreciate an answer rather than another question as an answer.

Of course the US spies on other countries, it's common knowledge.

Now I'll answer your question and as far as I'm concerned it ends this dialogue. I have no idea how much IP America has got from Chinese government, military, corporations and institutions, but if it isn't much then the American intelligence agencies are damned incompetent. I suppose if Edward Snowden was still around we might know.

A lot of this angst could be avoided by focusing attention on energy efficiency and conservation. But, nooooo, we'd rather focus attention on economic growth, money, and finance. Is it even possible to discuss a 'green future' without talking about money?

Rare earths are not that scarce. What makes rare earths 'rare' is that they are widely dispersed. It's possible to recover rare earths from desalination brine. But, hell no, that's not profitable. Money is the most important thing in this galaxy.

If energy production is a problem then it seems rather apparent the real need is to reduce energy consumption. That hasn't been a priority for the environmental movement or banking based government. It is easier to produce money than energy, after all. Just ignore the real world and everything will be fine.

I have seen a couple of documentaries which theorize that much more REE's are available for mining on the floors of the worlds oceans (makes sense considering how much of our planet is covered by water). While we currently lack the tech to access them it's only a matter of time.